Best EIN Services Of 2025

Compare top-rated EIN services to find the best fit for your business

Staff Writer

Arorix Editorial Team

Updated: June 14, 2025

1

9.8

EXCELLENT

Best for Overall EIN Value

- $70 add-on (or free w/ $199+)

- 1 year registered agent

- Lifetime compliance alerts

2

9.0

EXCELLENT

Best for Compliance + EIN Bundle

- $99 add-on (or free w/ $199+)

- Annual report alerts

- Registered agent included

3

8.8

EXCELLENT

Best for Branding With EIN

- $99 add-on (Elite $249+)

- EIN + compliance tools

- Logo, domain, site builder

4

8.5

EXCELLENT

Best for Privacy-Focused EIN Setup

- $99 add-on (Elite $249+)

- Private business address

- Expert EIN setup guidance

5

8.0

EXCELLENT

Best for Legal Support Access

- $79 add-on (Pro plan $249+)

- Attorney EIN guidance

- Trusted legal services brand

6

7.8

EXCELLENT

Best for Filing Help + EIN

- $199+ plans only

- EIN + annual report filing

- Handled in higher tiers

Looking for a Complete All-in-One Solution?

9.9

Best Overall Business Launch Solution

- EIN, docs, & custom branding included

- Access to Arorix OS™ business dashboard

- Website, CRM, and automation tools built-in

Our Top 3 Services

1

Best for Overall EIN Value

- $70 add-on (or free w/ $199+)

- 1 year registered agent

- Lifetime compliance alerts

9.8

2

Best for Compliance + EIN Bundle

- $99 add-on (or free w/ $199+)

- Annual report alerts

- Registered agent included

9.0

Best for Branding With EIN

- $99 add-on (Elite $249+)

- EIN + compliance tools

- Logo, domain, site builder

8.8

Best for Privacy-Focused EIN Setup

- $50 with SSN / $200 without

- Private business address

- Expert EIN setup guidance

8.5

5

Best for Legal Support Access

- $79 add-on (Pro plan $249+)

- Attorney EIN guidance

- Trusted legal services brand

8.0

Best for Filing Help + EIN

- $199+ plans only

- EIN + annual report filing

- Handled in higher tiers

7.8

Looking for a Complete All-in-One Solution?

Best Overall Business Launch Solution

- EIN, docs, & custom branding included

- Access to Arorix OS™ business dashboard

- Website, CRM, and automation tools built-in

9.9

An EIN (Employer Identification Number) is often required to open a business bank account, hire employees, or file certain taxes. Filing through a service saves time, ensures accuracy, and avoids dealing with confusing IRS forms—especially helpful for new business owners getting set up fast.

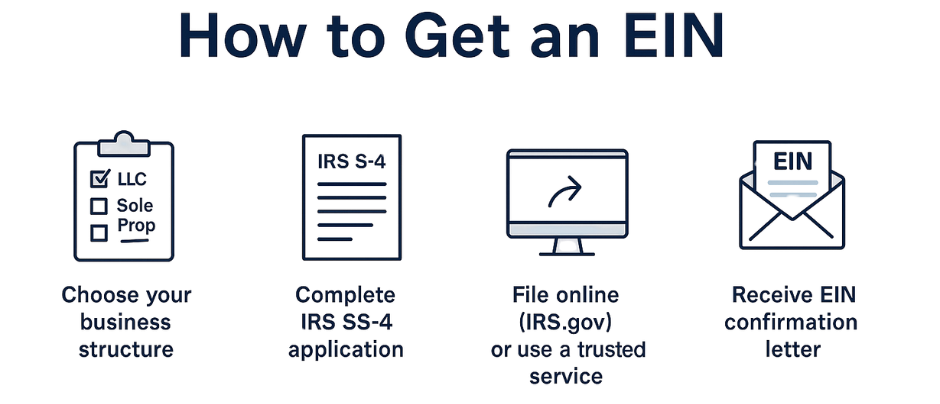

What Is an EIN (Employer Identification Number)?

An EIN is a 9-digit number issued by the IRS to identify your business for tax and legal purposes—like a Social Security Number, but for your company. It’s required for hiring employees, opening a business bank account, and handling federal taxes, no matter your business type.

What Is an EIN Used For?

Your EIN is your business’s tax ID—and it unlocks essential operations:

Open a Business Bank Account

File Federal & State Taxes

Apply for Licenses & Permits

Hire Employees & Run Payroll

Build Business Credit & Apply for Loans

Do Sole Proprietors and Single-Member LLCs Need an EIN?

Not always—but it’s often a smart move. If you hire employees, open a business bank account, or want to separate personal and business finances, you’ll need an EIN. It also helps build credibility and makes tax filing easier down the road.

Save Money: Get Your EIN Directly from the IRS — For Free

You Can Get Your EIN for Free

Many business owners pay $50–$100+ for something that’s totally free. The IRS offers a quick, online EIN application—no fees, no wait. You can get your official tax ID in minutes, straight from the source.

EIN Filing Fees and Costs

EIN Filing: Free & Fast via the IRS

The IRS offers EINs for free—and applying takes less than 10 minutes online.

Free Application Methods:

Online: Instant EIN after submission (most popular)

Fax: Send Form SS-4, get EIN in ~4 business days

Mail: Send Form SS-4, receive EIN in ~4 weeks

Phone: For international applicants only

Why Some Pay:

Done-for-you convenience

EIN bundled in LLC or corp setup packages

Step-by-step help for first-time filers

But if you’re comfortable applying yourself, the DIY route is quick, easy, and free.

Tip: Many third-party sites look official but charge for this free service. Always make sure you’re applying through the actual IRS.

Common Mistakes to Avoid When Applying for an EIN

Using the Wrong Entity Type: Make sure you select the correct business structure (LLC, sole prop, corp, etc.)

Multiple EIN Applications: Don’t apply more than once—each business only needs one EIN

Incorrect Responsible Party Info: Use the real individual who controls or owns the business

Using a Personal SSN for the Business Name: Only do this if you’re a sole proprietor without a DBA

Applying Too Early: Wait until your business entity is officially formed to avoid mismatched records

Using Unofficial Websites: Only apply through the official IRS site to avoid fees or scams

How to Choose the Right EIN Filing Option

Want It Free & Fast?

Apply directly on the IRS website — takes under 10 minutes, no fees.Want Help or Convenience?

Use a third-party service if you prefer someone to handle it for you—especially if bundled with LLC or corp formation.International Business?

Apply by phone with the IRS if you’re outside the U.S.

✅ Best for most: IRS online application — free, instant, and simple.