Best LLC Services Of 2025

Compare top-rated LLC services to find the best fit for your business

Staff Writer

Arorix Editorial Team

Updated: June 14, 2025

Best for Fast LLC Setup + Branding Tools

- $0 LLC + state fees

- Free compliance tools (1 year)

- Logo, domain, site builder

2

9.0

Best for Speed + Custom Compliance

- $0 LLC + state fees

- Fast filing + compliance alerts

- Custom operating agreement

3

8.8

Best for Free Registered Agent + Lifetime Alerts

- $0 LLC + state fees

- Free registered agent (1 yr)

- Lifetime compliance alerts

Best for Privacy-Focused Support

- $39 LLC + state fees

- Private, expert support

- No upsells or hidden fees

Best for Personalized, Family-Owned Service

- $99 + state fees

- Personalized family support

- Alerts, licenses, expert tools

6

7.8

Best for Trusted Name in Legal DIY

- $0 base plan (adds up fast)

- Legal help on demand

- Trademarks, contracts, add-ons

Looking for a Complete All-in-One Solution?

9.9

Best Overall Business Launch Solution

- EIN, docs, & custom branding included

- Access to Arorix OS™ business dashboard

- Website, CRM, and automation tools built-in

Our Top 3 Services

1

Best for Fast LLC Setup + Branding Tools

- $0 LLC + state fees

- Free compliance tools (1 year)

- Logo, domain, site builder

9.8

EXCELLENT

2

Best for Speed + Custom Compliance

- $0 LLC + state fees

- Fast filing + compliance alerts

- Custom operating agreement

9.0

3

Best for Free Registered Agent + Lifetime Alerts

- $0 LLC + state fees

- Free registered agent (1 yr)

- Lifetime compliance alerts

8.8

EXCELLENT

4

Best for Privacy-Focused Support

- $39 LLC + state fees

- Private, expert support

- No upsells or hidden fees

8.5

EXCELLENT

5

Best for Personalized, Family-Owned Service

- $99 + state fees

- Personalized family support

- Alerts, licenses, expert tools

8.0

EXCELLENT

6

Best for Trusted Name in Legal DIY

- $0 base plan (adds up fast)

- Legal help on demand

- Trademarks, contracts, add-ons

7.8

Looking for a Complete All-in-One Solution?

Best Overall Business Launch Solution

- EIN, docs, & custom branding included

- Access to Arorix OS™ business dashboard

- Website, CRM, and automation tools built-in

9.9

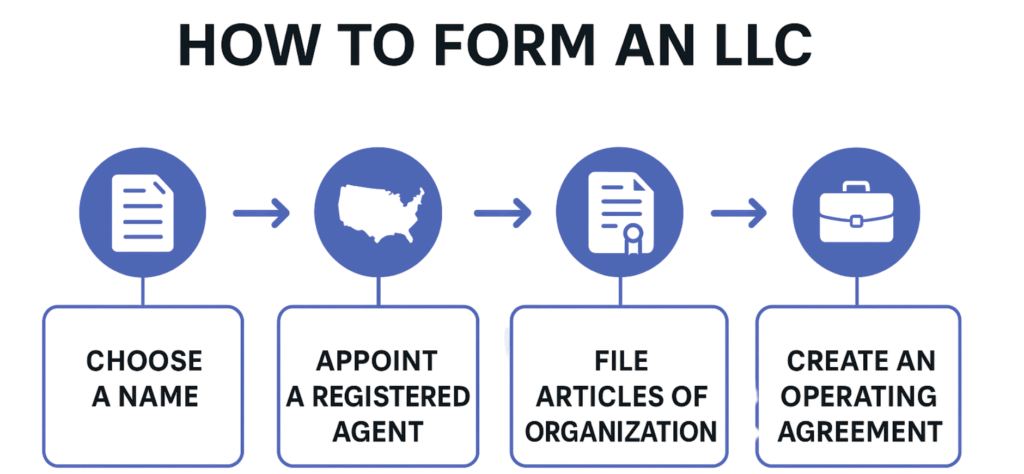

Starting an LLC is easier with a trusted formation service. They handle state-specific filings, reduce stress, and help you avoid mistakes. Many include extras like registered agent service, compliance reminders, and business license support—making the process faster and hassle-free.

What is an LLC?

An LLC provides personal protection with a straightforward setup.

It shields your assets from business liabilities while keeping taxes and paperwork light. Profits pass through to your personal return—no corporate tax. Whether you’re freelancing or launching a startup, an LLC adds credibility without the corporate complexity.

LLC Filing Fees and Costs

LLC costs to expect:

State Filing Fee:

$40–$500 one-time, varies by stateRegistered Agent (Optional):

$100–$300/year — often free for the first year with formation servicesOperating Agreement (Optional):

$0–$100 — highly recommended for multi-member LLCsAnnual/Biennial Reports:

$10–$200 depending on your state’s filing rulesBusiness Licenses & Permits:

Required for many industries — pricing depends on location and typeExtras (Logo, EIN, Website, etc.):

$0–$300+ depending on what you choose to add during setup

Tip: Some LLC services advertise "$0 to start" offers, but keep in mind that state fees still apply, and extra services may add to the final price.

Why Startups & Solo Entrepreneurs Use LLC Filing Services

Starting a business comes with enough challenges—your LLC paperwork shouldn’t be one of them. Filing services streamline the process, cut down on errors, and save time. Here’s what to look for:

Registered Agent Privacy

Keeps your address off public records and ensures you never miss legal notices.Operating Agreement Included

Pre-made and ready—no guesswork, perfect for solo founders.Multi-State Support

Run your business in one state while living in another, hassle-free.Articles of Organization

Core filing done for you—just make sure it’s part of the plan, not a hidden fee.Branding & Trademark Tools

Some platforms help you launch with a logo, domain, and trademark support.Affordable Plans

Great for every stage, with $0 startup options (plus state fees) for lean launches.

Common LLC Filing Mistakes to Avoid

Using Your Home Address

Makes your info public. Use a registered agent or virtual address for privacy.Skipping the Operating Agreement

Not always required—but essential for structure, clarity, and protection.No Registered Agent

You risk missing legal notices without one. Don’t rely on someone unreliable.Not Checking Name Availability

Filing with an unavailable name can delay or reject your application—always search first.Ignoring Compliance Requirements

Annual reports and state fees are ongoing. Miss them and you risk penalties or dissolution.Mixing Finances

Keep your LLC protection strong—open a separate business bank account.

How to Choose the Right LLC Filing Service

Transparent Pricing

Avoid surprise fees—look for clear, upfront costs.Included Essentials

Make sure basics like Articles of Organization and Registered Agent are in the plan.Fast Turnaround Times

Some services offer same-day or expedited filings—ideal if you’re on a timeline.Customer Support

Access to real help when you need it can save you time and stress.Custom Add-Ons

Look for extras like EIN registration, Operating Agreements, or branding tools.Strong Reviews & Reputation

Check ratings and user feedback to ensure the service is reliable and legit.Scalability

Choose a platform that can grow with you—offering upgrades for licenses, compliance, or multi-state support.