Best Corporation Services Of 2025

Compare top Corporation formation services to find the best fit for your business

Staff Writer

Arorix Editorial Team

Updated: June 14, 2025

Best for Budget-Friendly Filing

- $199 + state fees

- 1-year registered agent

- Lifetime compliance alerts

Best for Foreign-Owned Corporations

- $199 + state fees

- EIN, bylaws, resolutions

- Foreign-owned corp support

9.0

EXCELLENT

Best for Branding + Compliance

- $199 + state fees

- EIN, formation documents

- Logo, domain, website builder

4

8.5

EXCELLENT

Best for Speed + Simplicity

- $199 + state fees

- Fast filing, report alerts

- EIN, custom bylaws

Best for Privacy-Focused Support

- $39 + state fees

- Articles, bylaws, RA (1 year)

- Private, no upsells

6

7.8

EXCELLENT

Best for Legal Add-Ons

- $149 + state fees

- Bylaws, EIN, corp tools

- Legal services & upgrades

Looking for a Complete All-in-One Solution?

9.9

EXCELLENT

Best Overall Business Launch Solution

- EIN, docs, & custom branding included

- Access to Arorix OS™ business dashboard

- Website, CRM, and automation tools built-in

Our Top 3 Services

1

Best for Budget-Friendly Filing

- $199 + state fees

- 1-year registered agent

- Lifetime compliance alerts

9.8

Best for Foreign-Owned Corporations

- $199 + state fees

- EIN, bylaws, resolutions

- Foreign-owned corp support

Best for Branding + Compliance

- $199 + state fees

- EIN, formation documents

- Logo, domain, website builder

4

Best for Speed + Simplicity

- $199 + state fees

- Fast filing, report alerts

- EIN, custom bylaws

8.5

Best for Privacy-Focused Support

- $39 + state fees

- Articles, bylaws, RA (1 year)

- Private, no upsells

6

Best for Legal Add-Ons

- $149 + state fees

- Bylaws, EIN, corp tools

- Legal services & upgrades

7.8

Looking for a Complete All-in-One Solution?

Best Overall Business Launch Solution

- EIN, docs, & custom branding included

- Access to Arorix OS™ business dashboard

- Website, CRM, and automation tools built-in

9.9

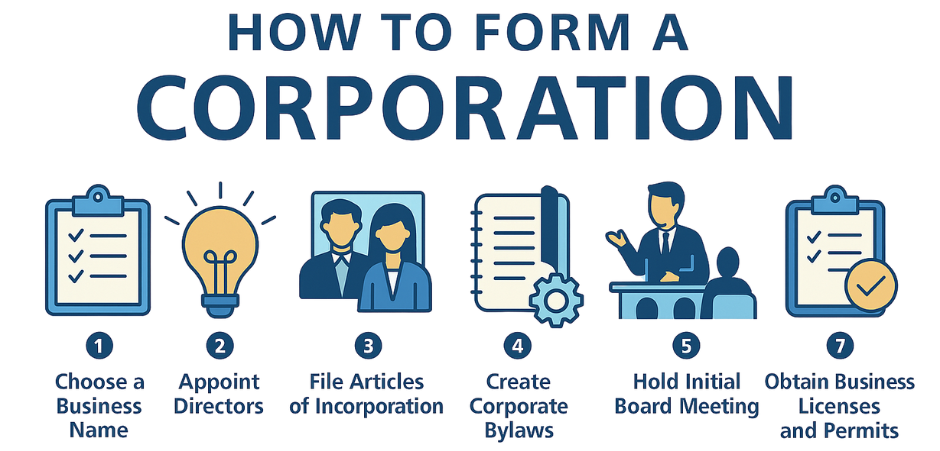

Starting a Corporation Made Simple

Incorporation services handle state rules, file your paperwork right the first time, and help you avoid costly mistakes. Many include extras like registered agent service, bylaws templates, stock issuance tools, and compliance reminders—making your launch faster, easier, and stress-free.

What is a Corporation?

A corporation is a separate legal entity from its owners—it can own property, sign contracts, and pay taxes on its own.

Types of Corporations:

C Corporation (C-Corp): Default structure; taxed separately

S Corporation (S-Corp): Pass-through taxation (IRS approval needed)

Tax Differences: C-Corp vs. S-Corp

C Corporation (C-Corp)

Double Taxation: Pays corporate tax + shareholders taxed on dividends

Flat 21% Tax Rate: Federal corporate income

No Pass-Through: Profits taxed at the corporate level

Fringe Benefit Deductions: Health insurance, etc., are deductible

Unlimited Shareholders: No limits, foreign investors allowed

S Corporation (S-Corp)

Pass-Through Taxation: Profits/losses go to personal tax returns

No Double Taxation: Only shareholders are taxed

IRS Election Required: Must file Form 2553

Ownership Limits: 100 shareholders max; U.S. citizens/residents only

Reasonable Salary Rule: Owner-employees must take payroll-taxed salary

Corporation Filing Fees and Costs

Required Costs

State Filing Fee: $50–$500+

Registered Agent: $100–$300/year

Name Reservation: $10–$50 (if required)

Franchise Tax / Initial Report: $0–$800+ (state-dependent)

Certified Copies / Good Standing: $10–$75

Optional Add-Ons

EIN Filing: Free via IRS, or $50–$100 through a service

Corporate Bylaws Template: Free–$100+

S-Corp Election (Form 2553): Free

Operating Docs Package: $50–$200

Service Packages

Basic: $0–$99 + state fees

Mid-Tier: $199–$249 + state fees (includes EIN, bylaws, compliance tools)

Premium: $299–$349 + state fees (full service + agent + alerts)

Tip: Using a formation provider can help you avoid missed steps and stay legally compliant.

What Are Corporate Bylaws and Why Do They Matter?

Bylaws are an internal document that outlines how your corporation is run. Most states require you to create them after incorporation—even if you don’t file them with the state.

Why They Matter:

Define officer roles, voting rights, and responsibilities

Required to stay compliant and legally protected

Often needed for bank accounts, loans, or investors

Help prevent internal conflicts and guide decision-making

What to Include:

Officer/director duties

Meeting rules and documentation

Shareholder voting process

Share issuance and transfer rules

Amendment procedures

Most formation services include bylaws, but make sure they’re editable and state-compliant.

Why Startups and Solo Entrepreneurs Use Corporation Filing Services

What Incorporation Services Typically Include

Registered Agent Service

Keeps your address private and ensures you don’t miss legal notices.Corporate Bylaws & Documents

Includes bylaws, share certificates, and resolutions to keep your structure compliant.Board Meetings & Resolutions

Tools to record initial meetings, elect officers, and issue shares properly.Articles of Incorporation Filing

Filed correctly with required info like share structure and business purpose.S-Corp Election (Optional)

Some services assist with IRS Form 2553 to help you save on taxes.Launch-Ready Add-Ons

EIN filing, name checks, compliance alerts, domains, and logo tools included in some plans.Affordable for Startups

Choose between low-cost filing or full-service packages with legal essentials.

Common Corporation Filing Mistakes to Avoid

Skipping Bylaws: Legally required—missing them can lead to disputes or noncompliance.

Not Issuing Stock: You must issue and document shares to maintain corporate status.

Using a Personal Address: Makes your info public—use a registered agent or business address.

Neglecting Board Meetings: Required for corporations—document major decisions to stay compliant.

Missing S-Corp Election: File IRS Form 2553 on time or risk default C-Corp taxation.

Ignoring State Requirements: Annual reports, taxes, and recordkeeping are mandatory—don’t skip them.

How to Choose the Right Corporation Filing Service

Clear, Upfront Pricing: Avoid hidden fees—know exactly what you’re paying for.

Included Essentials: Ensure it covers Articles of Incorporation, bylaws, and registered agent.

Experience With State Requirements: Choose a provider that understands your state’s rules.

Support for S-Corp Election: If needed, look for help with filing IRS Form 2553.

Document Quality: Templates should be professional, editable, and compliant.

Helpful Add-Ons: EIN filing, compliance alerts, domain registration, and branding tools are a plus.

Customer Reviews & Reputation: Look for strong ratings and reliable customer support.